Explain the Difference Between Debt and Equity Financing

With debt this is the interest expense a company pays on its debt. The difference between debt and equity capital are represented in detail in the following points.

Debt Financing Vs Equity Financing What S The Difference

Debt is the borrowed fund while Equity is owned fund.

. Is usually lower than the cost of equity for the reasons mentioned above taking on too much debt will cause the cost of debt to rise above the cost of equity. Alternatively equity finance is sourcing money from within your business by selling shares. Ownership When equity investors purchase a share in your company your own shareholding would reduce but with debt financing you retain 100 ownership.

You do not have investors or partners to answer to and you can make all the decisions. Differences Between Debt and Equity Equity is helpful for those who would like to go public and sell the shares of the company to individuals. Debt financing Debt financing is when a company takes out a.

Established businesses are usually able to get a wider variety of financing options. Debt and equity financing are two very different ways of financing your business. No one knows the needs of your business better than you.

Debt Financing vs. Equity financing involves the owner giving up a share of the business. Often new small businesses struggle to get equity financing so they must take on debt.

Three 3 personal trainers at an upscale health spa resort in Sedona Arizona want to start a health club that specializes in health plans for people in the 50 age range. While both methods can provide you the capital you may need take the time to evaluate the pros and cons of debt vs. A really interested investor might give enough money to not only launch your business but to fund years of operation and even additional product development.

You own all the profit you make. Extra funds can be obtained through traditional debt finance which is taking out a loan from a bank or other lender. High-growth businesses may want to go public in the future and they may seek venture capital.

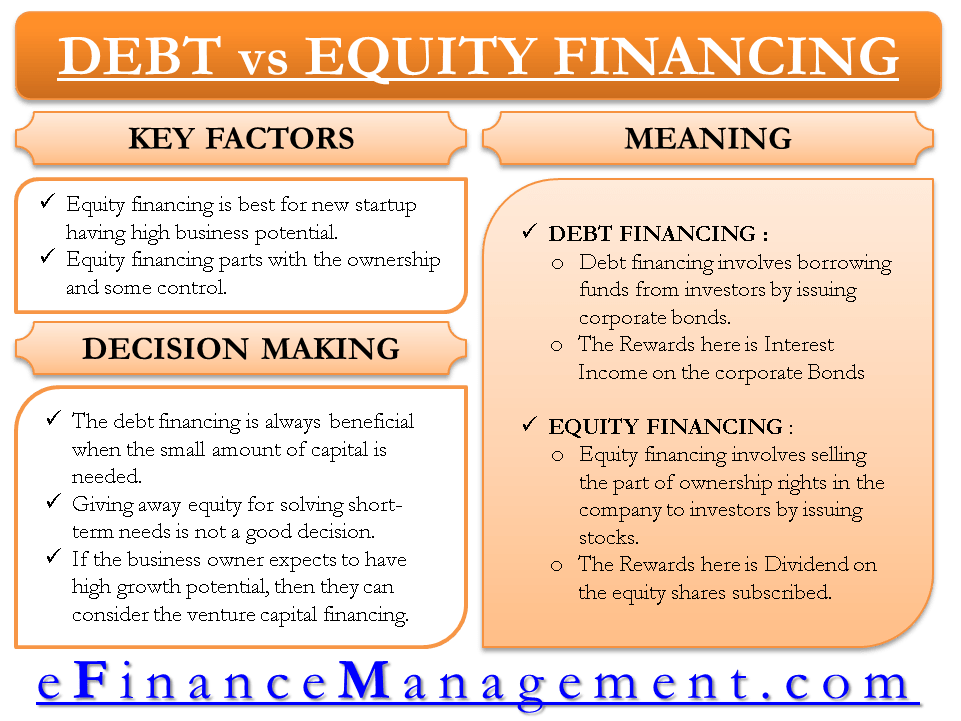

The primary difference between debt and equity financing is the type of instrument the company issues in order to raise the capital it needs. This is because the biggest factor influencing the cost of debt is the loan interest rate Interest Rate An interest rate refers to the amount charged by a lender to a borrower for any form of debt given generally expressed as a. In debt financing the company issues debt instruments such as bonds to raise money.

Explain the major differences between equity and debt financing and discuss the primary ways in which each would affect the future of the partners business. Debt is the companys liability which needs to be paid off after a specific period. This increase will cause the previous stockholders ownership percentage.

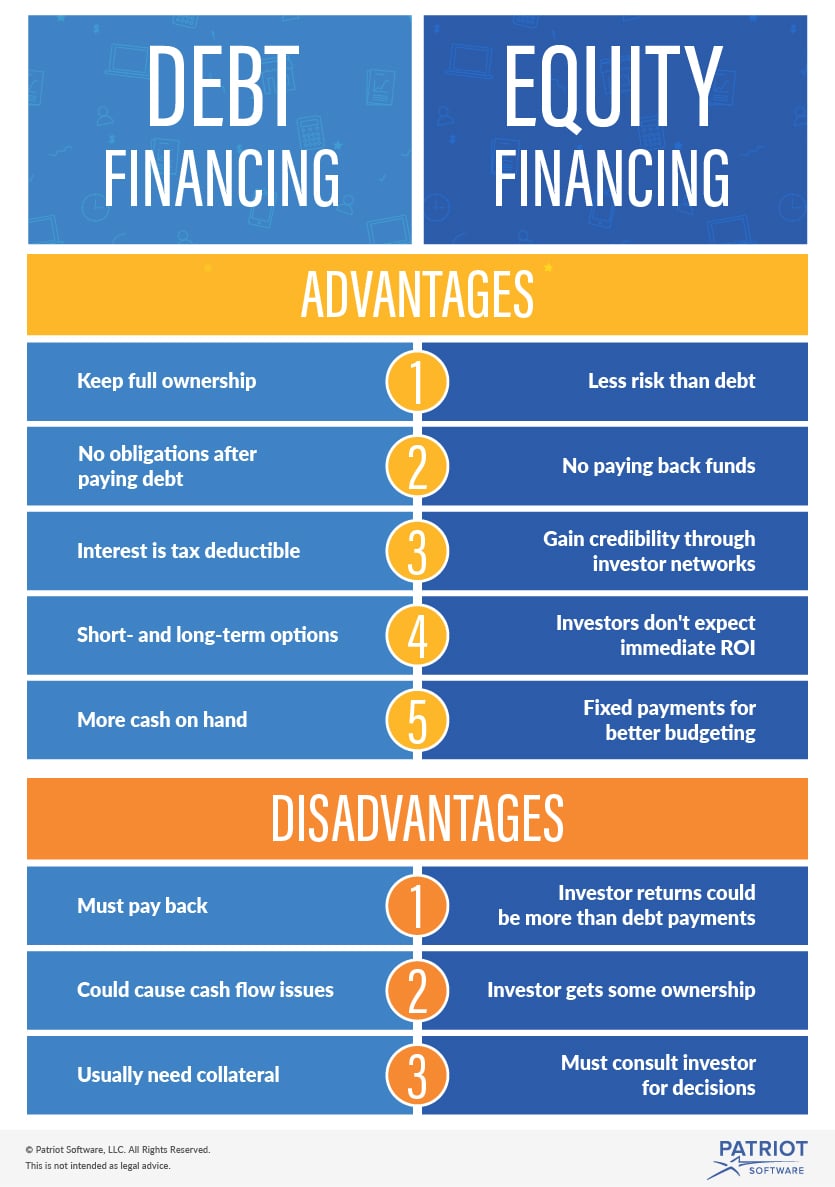

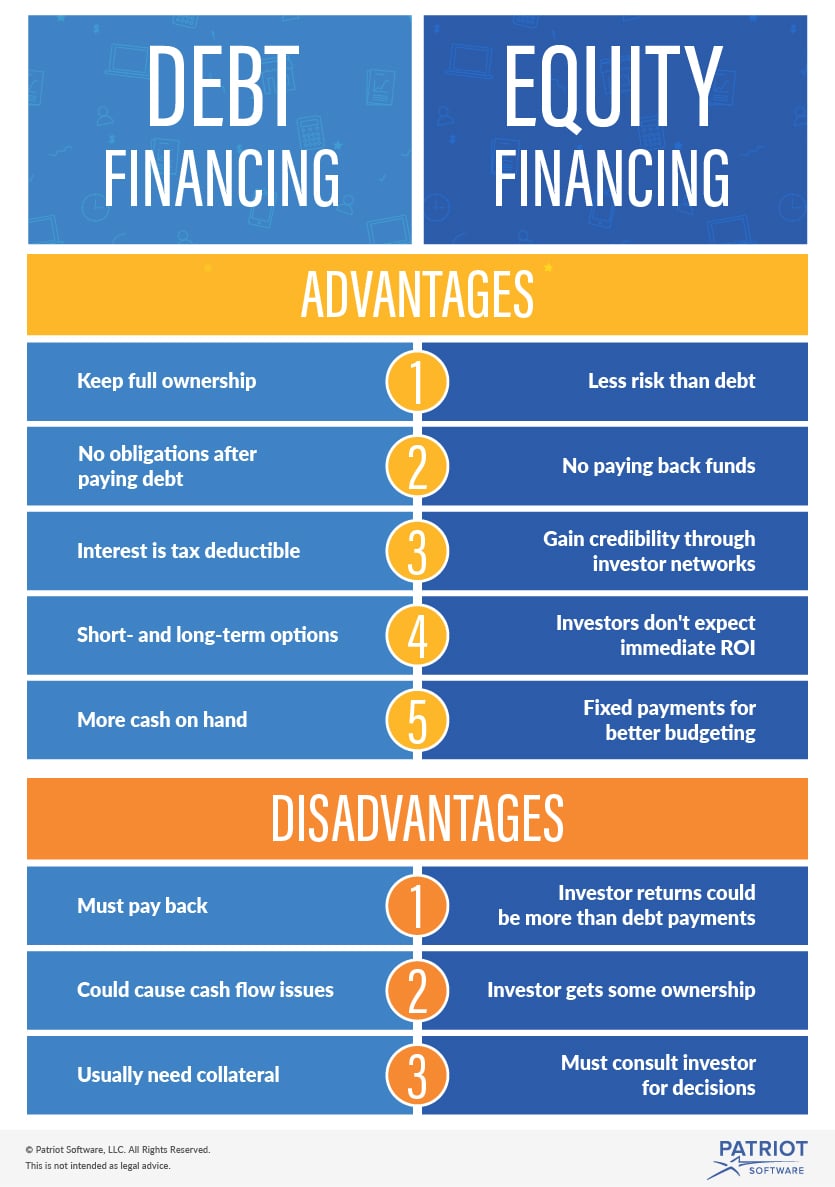

Advantages of Debt Financing. Equity financing involves increasing the owners equity of a sole proprietorship or increasing the stockholders equity of a corporation to acquire an asset. This means that it shields part of.

Debt reflects money owed by. Money raised by the company by. Debt involves borrowing money directly whereas equity means selling a stake in.

Businesses opt for debt for two main reasons. The main advantage of. Lets break down the differences.

Debt always involves some form of repayment with interest that must be made whether the company is making a profit or not. Debt Funding involves borrowing money from a legal institution such as a bank as long as agreeing to pay some interest which is basically the price of money. This can be challenging to secure if the business is unproven.

Definition of Equity Financing. All theyll need in return is partial. Both debt and equity financing supply a company with capital but the similarities largely stop there.

Explain the major differences between equity and debt financing and discuss the primary ways in which each would affect the future of the partners business. Debt financing involves the borrowing of money whereas equity financing involves selling a portion of equity in the company. Debt has the advantages of not compromising future profits of.

The right funding option is different for every business owner when it comes to equity financing vs. Due Week 8 and worth 200 points Three 3 personal trainers at an upscale health spa resort in Sedona Arizona want to start a health club that specializes in health plans for people. In the case of debt the story is slightly different.

Choosing between debt and equity financing. Hence unlike debt financing which presents a pre-determined cost equity financing has a more variable cost because its a stake in the future value and earnings of your business. Debt and equity financing are the two ways that a firm may obtain the required funds for business activities.

If you finance your business using debt the interest you repay on your loan is tax-deductible. Debt financing allows you to have control of your own destiny regarding your business. Debt financing has a limit depending on your credit and how much youre able to repay but equity financing is limited only by how much your investor is willing to give you.

Unlike debt equity financing doesnt require repayment. Debt financing requires a firm to obtain loans and pay large sums of interest while equity financing is obtained by selling shares and paying dividends to shareholders. 11 rows The primary difference between Debt and Equity Financing is that debt financing is the.

Knowing your options and the needs of your business can make all the difference when it comes to choosing between debt vs. In a nutshell. An Overview When financing a company cost is the measurable expense of obtaining capital.

Debt and Equity Funding are considered two different categories of financing resources for business owners who demand capital to expand. It can be short-term long-term or revolving. When a corporation issues additional shares of common stock the number of issued and outstanding shares will increase.

With equity financing a company raises capital by issuing stock. 9 rows Debt financing means where the lender provides loans to the borrower and charge interest on the. Equity Financing vs Debt Financing.

Equity financing is borrowing money from a lender in exchange for equity. Debt financing is borrowing money from a lender in exchange for interest payments.

Debt Vs Equity Financing Efinancemanagement

No comments for "Explain the Difference Between Debt and Equity Financing"

Post a Comment